- Milton Keynes 01908 660966

- Northampton 01604 828282

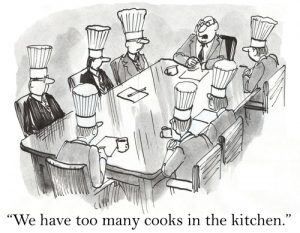

‘Too many cooks…’ – Director and Shareholder Disputes

Family owned businesses can suffer with shareholder disputes just like any other. In the case of Waldron & Others v Waldron & Another, the High Court considered the issues surrounding the conduct of a Managing Director of a family owned company and whether his Shareholder siblings had been unfairly prejudiced.

Multiple shareholders in dispute

Multiple shareholders in dispute

The company was owned by four siblings all of whom had inherited their respective Shareholdings from their parents. We have referred to the Company’s majority shareholder and Managing Director as A. In addition, B describes a minority Shareholder and Director and C a minority Shareholder and the Company Secretary. D was a minority Shareholder that was not actively involved in the running of the company. As well as the four siblings, a corporate entity known as SIG also held shares in the business.

A identified an opportunity to purchase assets from a separate business that had entered administration. To facilitate an acquisition of those assets, A incorporated a new corporate vehicle and hired the assets purchased through this new entity to the family business at an excessive charge. B and C alleged that A had entered into an arrangement in order to extract value from the family business. They alleged the excessive charge worked to their detriment.

A approached SIG to acquire its shares in the family company. The approach resulted in a breakdown in the relationship between the siblings over the proportions in which they should acquire the shares from SIG. A wanted to acquire all of SIG’s shares, whereas the other siblings argued that the distribution of those shares should be in proportion to existing shareholdings.

Communication between the parties became strained and a dispute arose which resulted in A restricting B and C’s email access to company business and B and C offering money to an IT consultant to provide them with access to A’s emails. A discovered that B and C had access to his emails and dismissed B and C as employees of the company based upon their divisive step to access his emails without his knowledge.

B and C claimed that A’s behaviour amounted to unfair prejudice. Relying upon the principle that a member of a company can ask the Court for relief (i.e. a solution to the problem) if the affairs of the company are being conducted in the manner that is unfairly prejudicial to their interests of a member. The case went to Court.

The Courts findings

The Judge found that A’s behaviour in authorising the lease of assets to the company was unfairly prejudicial as he had placed himself in a position of conflict of interest. A had failed to seek permission from the company for this conflict and therefore breached his Director duties. The Court found that even though A believed the arrangement would be of benefit to the company, this in itself was irrelevant.

However B and C had learnt of the hire arrangements soon after they were put in place and yet still did nothing about the arrangement at that time. The Court found that they had in effect acquiesced in the breach and this therefore prohibited them from making a later claim. The Court found this also applied to D who whilst unaware of the hire agreement had been content to leave the running of the company to her brothers.

Turning to the email access, the restriction of B and C’s email access according to the Judge had not amounted to unfair prejudice. The High Court Judge found that although a company’s board was entitled to full information about every aspect of the company’s affairs, a Director did not necessarily have automatic right to see all emails or documents generated in the course of business. He added that there may be circumstances where a Managing Director or Chairman needed to deal with matters confidentially.

In addition, A’s dismissal of B and C had also not amounted to unfair prejudice because there was good reason for their dismissal. Their attempt to bribe a consultant to provide unauthorised access to emails was, according to the Court, “manifestly improper”.

What can be learnt from this case?

This case from March 2019 is a reminder that a company’s covenants with regards to the declaration of conflict remains as important as ever. Even though the arrangement arising from the conflict of interest is of benefit to a Company it does not mean that it overcomes a breach of duty. Complying with the Director’s duties remains paramount.

Another lesson with this case was that a shareholder who feels the company’s business is being run to their detriment must act quickly. Sitting on their hands in full knowledge of the issues and allowing it to continue may push a Shareholder into a position whereby they lose the remedy that they would later wish to seek.

Further, Directors may not have unfettered access to all records relating to their company. Whether a Director is entitled to see a particular document will always depend on the nature of the document and the reasons for which the Director is asking to see it.

If you are in doubt regarding your obligations as a director or indeed your rights as a shareholder, seek early advice. This can avoid what can be a lengthy and costly dispute.

For further advice and assistance please contact our Private Client Team on 01604 828282 / 01908 660966 or email info@franklins-sols.co.uk