- Milton Keynes 01908 660966

- Northampton 01604 828282

What is a Shareholders Agreement and do I need one?

As a corporate lawyer a fundamental aspect of the work that I undertake on behalf of our clients is the acquisition of shares in a company. Having carefully structured the requisite documentation providing for a successful purchase, the work does not end there. Post-acquisition, the focus shifts to the governance of the company moving forward and ensuring that the success of the company is always at the forefront of its shareholders minds. Therefore, just like the carefully structured transactional documentation effecting the purchase of the company, consideration should be given to the preparation of a carefully structured Shareholders Agreement.

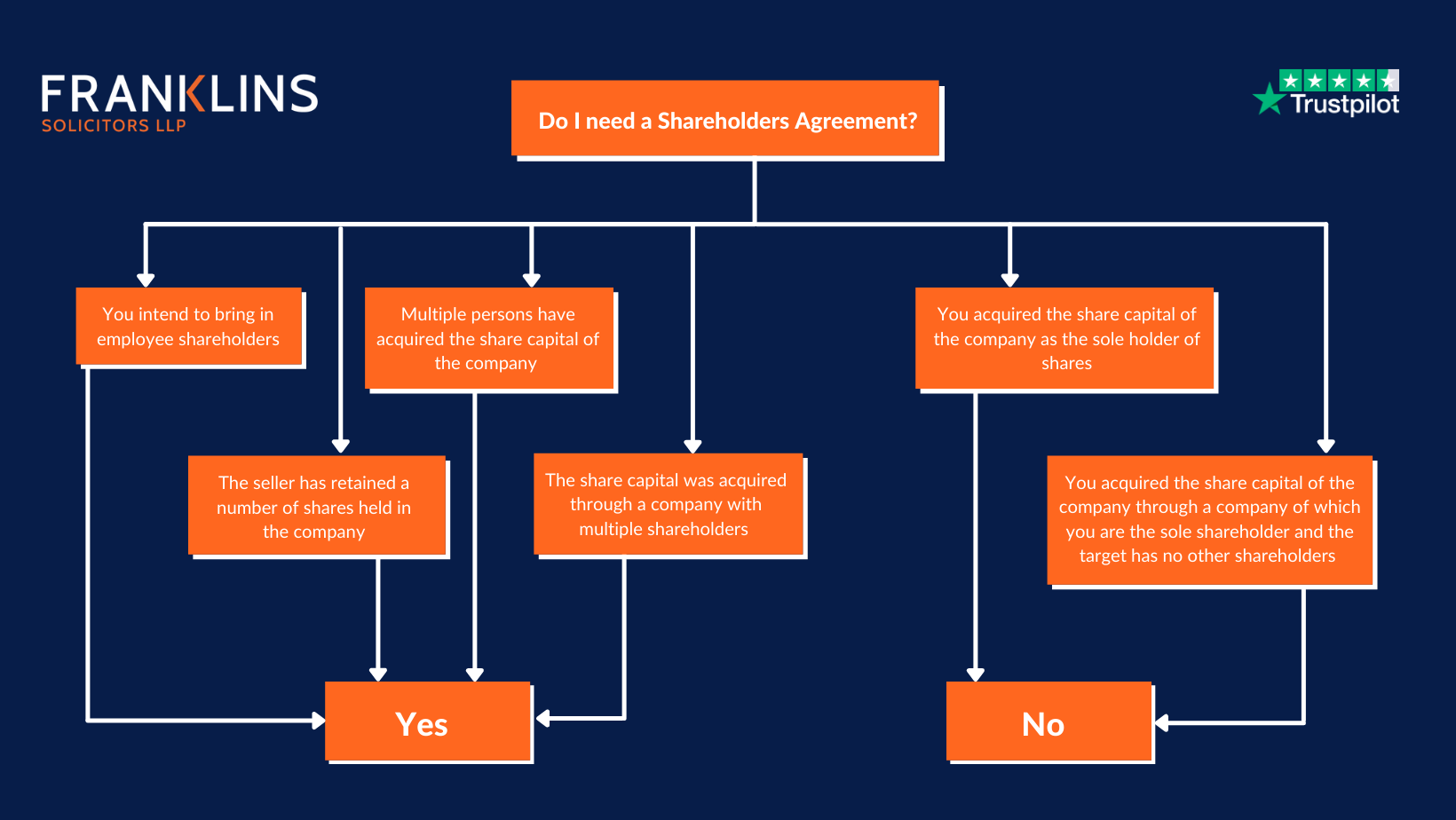

Do I need a Shareholders Agreement?

A Shareholders Agreement is always recommended where you have multiple shareholders. This is irrespective of any familial relations, friendship or pre-existing ties that the shareholders may have. As you will see, a Shareholders Agreement is key to ensure that each shareholder is accountable for keeping the company’s interests at the heart, and in the case of connected shareholders it can underpin that separation of ‘business’ and ‘pleasure’ that can easily be lost when running a company together.

Do I need a Shareholders Agreement flowchart

Having established whether a Shareholders Agreement is appropriate for you and the share structure of the company, the question turns to what is a Shareholders Agreement?

What is a Shareholders Agreement?

Engage with a corporate lawyer at any stage of your corporate journey and no doubt they will ask you whether you have a Shareholders Agreement in place – but what actually is a Shareholders Agreement and how will this help promote the success of the company?

A Shareholders Agreement is a private agreement between the shareholders of the company whether that consists of multiple individuals, multiple corporate entities or a parent company with multiple shareholders. The agreement binds them to certain provisions balancing their individual interests and that of the company whilst offering a solution to resolve any issues encountered in a clear and amicable way.

Whilst there is no legal requirement for you to have a Shareholders Agreement in place, from experience there will be times when the shareholders reach an impasse and are unable to reach a solution and my first question is always “Do you have a Shareholders Agreement?”. Unfortunately without the presence of a Shareholders Agreement there is no easy solution and costly litigation often follows.

“Prevention is always better than cure.”

What is included in a Shareholders Agreement?

Each Shareholders Agreement is different and should be tailored to your own needs. When I am assisting clients with their Shareholders Agreements, it is important to get to know the company, its nature, the structure and how the shareholders intend to deal with the internal affairs of the company.

Whilst the Shareholders Agreement can provide a solution to resolve any internal disputes and how these will be resolved, it also cover the internal affairs and management of the company with a view of promoting the success of the company – these could include:

- provisions for restricted decision making so that it is agreed that certain decisions will require majority or unanimous consent

- the type of business which the company can undertake

- access to financial information for all shareholders

- restrictive covenants and confidentiality provisions to protect the goodwill of the company

- transfer provisions to prevent shares being transferred to third parties without first being offered to other shareholders

- ‘Deemed Transfers’ so that in certain circumstances (such as bankruptcy and death) there is a notice deemed to have been served to the continuing shareholders and the company so that they can purchase shares from the effected shareholder

- rights of minority shareholders to tag-along with a third party offer to purchase share capital held in the company

- rights of majority shareholders to drag-along minority shareholders in a proposed share capital sale to a third party

- rights of employee shareholders – including good/bad leaver provisions in the event the employee leaves the company

The above mentioned points are only a summary of the key provisions that I would expect to see in a well-structured Shareholders Agreement. However, as I mentioned above every company is unique and it is important that you make sure that you have an agreement that is tailored to you.

If you would like to discuss whether or not you need a Shareholders Agreement and what is included, contact Robyn Jefferies and the Corporate Team on 01604 828282 / 01908 660966 or email Corporate@franklins-sols.co.uk.