- Milton Keynes 01908 660966

- Northampton 01604 828282

Every transaction, whether a share sale, business sale, management buy-out, merger, share scheme (the list goes on!) will be governed by legal documents. These are essential to governing the relationship between the parties and sets out what has been agreed. This is important not only in relation to any ongoing matters between the parties post-deal, but also to any third party onlookers who may need to know about the transaction (in particular, HMRC).

What documents are included?

The actual documents that can be expected will vary between transactions, depending ultimately on the deal structure you are agreeing and what you have to sell. However, typically these may include:

- Pre-Transaction Heads of Terms and NDA – these are designed to set out the headline terms of the deal and protect your information during the disclosure process.

- Purchase Agreement – this will govern the operative terms of your transaction including the purchase price, when this is due and the warranties and assurances that you will be required to give the buyer as a part of the transaction. It may also include a tax covenant and a mechanism to adjust the purchase price based on performance.

- Disclosure Letter – this is a formal letter from a seller to a buyer setting out any facts or circumstances which contradict a contractual warrant being asked of them. Where something is properly set out in the Disclosure Letter, the buyer acquires the business in that knowledge and cannot then claim against the seller in respect of that issue.

- Service Agreements and Settlement Agreements – if you are also an employee of the business, it may be that your employment needs to be terminated on completion. Similarly, if you are going to continue to provide services post-completion then you may require a service agreement to govern this relationship.

- Property Transfer Documents – if there is going to be any change to property ownership in the transaction, you will need documentation to deal with this. This may include a TR1 and contract for sale if transferring the freehold or registered lease, or a Deed of Assignment and Lender Consent if transferring a lease. This is particularly key if undertaking a ‘business sale’ or ‘asset transfer’

- Contract Assignments – you may need to transfer rights or obligations from one party to another as a part of the transaction, particularly if a ‘business sale’ or ‘asset sale’. This can include assigning intellectual property, goodwill or even contracts with customers or suppliers.

- TUPE Notices – if you are undertaking an ‘asset transfer’ or ‘business sale’ and have employees, you will need to notify them in accordance with their statutory rights and your statutory obligations.

- Ancillary Documents – in addition to the operative purchase agreement, you may also need various ‘ancillary’ documents to effect the transactions it anticipates. This would include stock transfer forms, board minutes for any companies involved in the transaction, resolutions that are required to be passed, powers of attorney and indemnities for any lost/unissued share certificates, directors consents and resignations and notices for changes of persons of significant control. What you actually need will vary on each transaction.

- Companies House returns. If you are selling a company, there are certain returns that need to be filed at Companies House within statutory deadlines.

Who is involved in this process?

Your legal team is key to drafting, negotiating and amending these documents. The buyer and seller have adverse interests in a transaction and therefore it is important that you appoint an independent solicitor to advise you in the sale and negotiate the documents on your behalf to ensure that they also include adequate protections for you as a Seller and that you are fully informed of the risks of proceeding. They will also work closely with your accountant and other advisors to ensure that they also account for any tax or accounting elements that need to be accommodated.

If you want to know more about the process of selling a business and how we can support you…please do contact Holly Threlfall or the team on 01604 828282 / 01908 660966 or email info@franklins-sols.co.uk

Now you know what is involved in selling your business, you know how important it is to have the right team around you to guide you with each element of your transaction and ensure the best outcome for you.

So you’ve found a buyer and agreed Heads of Terms, now it’s time for the hard work to begin! From my experience, the most commonly underestimated work-load in the transaction is legal due diligence enquiries. Accounting and Commercial due diligence often starts at the Heads of Terms stage as the buyer uses basic enquiries and a combination of assumptions to reach a price they are willing to pay in principle. However, before actually proceeding they will want to know everything about how your business operates.

What questions are they likely to ask?

Legal due diligence will vary depending on the nature of the business, size of the transaction and how the deal is structured (there is usually reduced due diligence for a business purchase as compared to a share purchase, but this isn’t always the case). Typically, legal due diligence covers the following topics:

- Corporate Structure and Records – this is the background to your company, how it is set up and managed, what it’s governing documents consist of and compliance with statutory registers and records.

- Share Capital and Shareholders – this is crucial in a share transaction and will enquire into who actually owns the shares being sold and any matters that may impact those shares.

- Accounts and reports – this covers the Company’s historic statutory accounts, practices and management accounts since the last statutory accounts. It also considers any forecasting or budgets and changes since the last accounts date.

- Finance and Banking – this is designed to gather information in relation to the financial facilities available to the business or needed to operate it (e.g. credit cards, overdrafts, grants, long-term loans, invoicing or other facilities) and even without any of these at the very least the bank accounts the business uses and cash in the bank.

- Business, contracts and trading – this section is fundamental in any transaction as it covers the contractual arrangements that the business has and needs to trade. Crucially, a buyer needs to know about any material contracts and ensure these will continue.

- Assets – this covers the equipment, plant and machinery the business needs to operate. It can also extend to stock levels.

- Real Property – this covers the premises used to operate the business from and captures information regarding leasehold and freehold interests. It is common for this to extend not only to basic questions to understand what there is but appropriate Commercial Property Standard Enquiries (CPSE’s) in relation to those premises.

- Intellectual property – this covers what intellectual property is used by the business, who owns it and any licences required.

- Information Technology – this covers the computer systems used in the business, their maintenance and any vulnerabilities. This has become particularly crucial in recent years with the growth of cyber-attacks.

- Data Protection and privacy – this is geared at compliance with strict statutory obligations in relation to how personal data is stored and processed. Particularly in view of the changes in GDPR!

- Insurance – the buyer needs to ensure adequate insurance, the types of claims historically brought and any residual issues they may inherit

- Regulatory compliance and consents – this is more key in businesses which are subject to a regulatory authority. For example those subject to FCA authorisation or SRA Registration. But this can also cover Premises Licences and Waste Carrier Licences. In effect, any governmental authority or consents required to run the business.

- Litigation – any buyer will want to know about litigation that has been issues and which could impact the target they are acquiring.

- Employment – employment law is a very niche topic and there are a whole host of laws which apply when you engage employees and these questions are designed to understand not only what employees are needed to run the business, but also ensure compliance with all laws. This can be particularly key in a business sale where ‘TUPE’ applies. If you want to know more about this, do contact our employment team who would be happy to help!

- Retirement Benefits – just as employment law needs to be covered in view of the legal requirements to provide a pension scheme and auto-enrolment obligations any buyer needs to fully understand what has been effected and what their ongoing liabilities may be

- Environment, Health and Safety – it is important for a buyer to understand about what health and safety procedures you have in place and environmental factors which may impact the business. In particular, what environmental and health and safety laws apply to the type of business they are acquiring and how they have been complied with. From cleaning products to storage of sewage tanks, the buyer will want to know what impact these have on your business.

- Anti-Bribery and Corruption – There is strict legislation in place around bribery offences therefore a buyer will want to know what measures you have taken to prevent this.

- Tax – compliance with tax legislation is important to any business and the buyer will want to understand not only how this has been dealt with historically, but the taxes due and any exemptions that have been applied. For example, capital allowances that have been claimed, some services or supplies are VAT exempt or sometimes R&D claims have been applied for. They will want to know this.

Who is involved in this process?

Primarily, you will be heavily involved in this process as you, together with your staff and managers, will know how the business operates and be gathering this information. Some of it, your accountant may also be able to assist with and we would work with you to manage the disclosure process.

How to manage this process?

Managing the due diligence process is daunting – particularly when you are trying to sell your business without any third parties (particularly staff, suppliers and customers) finding out about the transaction. This can therefore be one of the most stressful parts of a transaction. Technology can help with the provision of secured data rooms which makes it easier for information gathering and sharing but at the end of the day there is always going to be a fair bit of leg-work on your part! This can however be made easier if you plan to sell in advance of having a buyer lined up. We do offer a service where we can work with you to undertake this process with you before your buyer comes on board. This enables you to undertake due diligence at a manageable pace with less pressure. It also gives us the chance to review responses and advise on any potential issues we identify so that they can be rectified before you have a buyer. For instance, many companies don’t maintain statutory books which is a fundamental legal requirement and could cause an issue with your buyer.

For more information on our legal due diligence audit service and how we can help you prepare for a sale, please contact Holly Threlfall or the team on 01604 828282 / 01908 660966 or email info@franklins-sols.co.uk

What next?

Now we move on to preparing the documentation.

Once you have resolved to sell your business and decided on a structure that is going to suit you, the next stage is finding a prospective buyer and agreeing Heads of Terms. Taking your business to market can be a daunting process; especially as it is something many owners of private companies may only do once! But you are not alone in this process and the broker that has helped you construct the right valuation and deal for you can also assist in taking your company to market in a discreet and confidential manner.

Once you have found a buyer, the next thing you will need to agree are Heads of Terms.

What is the point of Heads of Terms?

Heads of Terms set out the principle terms of the deal that the parties are committing to negotiate. Generally speaking, they are ‘non-legally binding’ and should be drafted so that the majority of clauses (with a few exceptions) are subject to contract. Whilst it may seem unnecessary to negotiate an ‘agreement to agree’ the point of Heads of Terms is not to get into the devil of the detail for the transaction, but to outline the basic principles of the deal, timescales and responsibilities. After the Heads have been agreed, you then get into the due diligence stage of the transaction which will further influence what detail needs to be contained in the transaction documents themselves.

Why aren’t heads legally binding?

The majority of clauses in Heads of Terms aren’t legally binding as it allows:

- The parties to incur substantive costs in the knowledge a deal has been agreed in principle

- The parties to seek and further negotiate the terms of the deal when they have the benefit of responses to due diligence enquiries

What is in Heads of Terms?

As every deal structure is different, the provisions contained in the relevant Heads of Terms will vary. However, there are a few fundamental provisions that you would expect to find in Heads including:

- a paragraph setting out the structure of the deal, the proposed purchase price and when this is due

- an outline of the expectations in terms of due diligence enquiries

- an outline of the expectations of the Purchase Agreement and who is going to prepare it

- a legally binding confidentiality clause

- a legally binding exclusivity clause

- a legally binding costs and jurisdiction clause

What is an NDA

An ‘NDA’ or ‘Confidentiality Agreement’ is an agreement designed to protect both your information and the Company’s. It commonly involves:

- an obligation to keep information secret; and

- an obligation to only use information for a specific purpose.

This may be included within your Heads of Terms or you may have a standalone agreement. Either way, it is essential before proceeding that you have a comprehensive legally binding provision in place.

Who is involved?

Typically, the buyer’s solicitor would prepare the Heads of Terms for a transaction. That being said, your broker, agent or CF advisor may also commonly prepare Heads of Terms and certainly would be involved in considering and commenting on the purchase price, deal structure and how this is constructed.

If you have been presented with a set of Heads of Terms or need assistance navigating your sale, please don’t hesitate to Holly Threlfall or the team on 01604 828282 / 01908 660966 or email info@franklins-sols.co.uk

What next?

Once you have signed Heads of Terms, it’s time for the parties to move onto due diligence enquiries.

Selling a business can be daunting. There are a multitude of considerations that you will need to have, decisions to make and unfamiliar processes to engage in. If you want a successful sale you need to prepare not only your business but yourself for the sales process. Doing so will not only maximise on your sale value, but reduce stress and anxiety by ensuring that you are fully appraised and confident in the decisions you make. In this series, I am going to consider five key elements of any transaction that a Seller will need to consider:

- Determining the structure of transactions

- Heads of Terms

- Due Diligence Enquiries

- Transaction Documents

- The teams involved in your transaction

Transaction Structures

Transactions can have a multitude of different structures and each deal will need to be tailored to you and impacted by how you have operated to date. However, there are two key principle ‘sale structures’ commonly adopted: Share Sales and Business Sales. Although each transaction will follow the same pathway of heads of terms, due diligence and transaction documents the actual documents themselves and risks involved in each transaction does vary significantly.

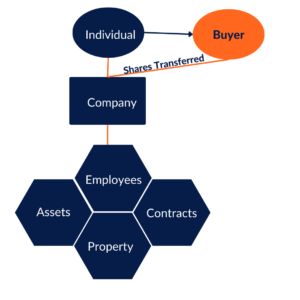

Share Sales

A Share Sale is more commonly preferred by Sellers where you have operated through an incorporated company. This is where you personally sell the shares that you own in your company to your buyer. The business itself remains ‘intact’ and therefore no property transfers, TUPE transfers or contract assignments are required which can help preserve the continuity of business and cause less disruption to the day to day running of the business.

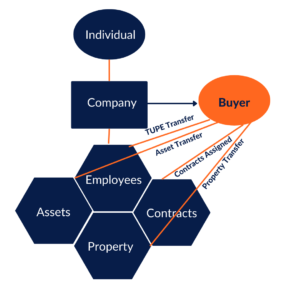

Business Sale

A ‘Business Sale’ or ‘Asset Sale’ (which are very similar in nature) is where an individual or a company sells the components or specific assets which together make up a business. Whilst this can be a lower risk from a buyer perspective, it can cause more disruption to the business as you have to transfer each asset and obligation to the buyer for them to continue the business and may involve TUPE transfers, property transfers and contract assignments.

Which is Best?

There are pros and cons to both structuring the deal as a Share Transaction or a Business/Asset Transaction.

Structuring the deal as a Share Transaction may:

- be more tax efficient for a seller

- involve a higher level of due diligence and disclosures

- involve a substantial number of documents to effect the share transfer and change of ownership itself

- increase the risk to a buyer as they inherit both liabilities and assets

- cause less disruption to the operation of business itself

Structuring the deal as a Business Transaction may:

- enable the buyer to ‘cherry pick’ assets and ‘leave behind’ certain liabilities

- involve more documentation to physically transfer the assets to the buyer

- cause more disruption to the business, especially if there are employees who need to be consulted on the pending transfer of the business

- involve more costs for the buyer, especially if property needs to be transferred which could incur Stamp Duty Land Tax

- Reduce the direct liabilities of the individuals involved in the deal if they operate through a selling company

Ultimately, every transaction will be different and what works for one set of parties may not work for another. It is about balancing the risks and benefits of the parties in each deal to agree a structure which both are happy to proceed on.

If you would like to know more about structuring deals and considerations in a pending sale, please don’t hesitate to contact Holly Threlfall or the team on 01604 828282 / 01908 660966 or email info@franklins-sols.co.uk

Who can help you with your structure?

Planning the structure of your transaction involves not only your solicitor, who can advise on the various risks and accountant, but also a broker (usually an expert in Corporate Finance) who can help with only valuing your business; this can be impacted by many factors including turnover, profit, industry multipliers and net asset value). Having an agent on hand who can help you construct a the deal in a manner that suits you and help you handle any key negotiation points early on is key to lining up a successful sale

What next?

Once you have agreed a structure in principle, it’s time to move onto Heads of Terms.

Andrea Smith is an equity Partner at Franklins Solicitors and heads up our Business Services Department. In this blog she explains why she has chosen to progress her career within Franklins and what her role entails…

I joined Franklins Solicitors nearly 21 years ago as a Trainee Solicitor and was offered a position post qualification, working alongside Simon Long, who is now our Managing Partner. I worked very hard and became a salaried Partner (referred to within the firm as a Level 2 member). I continued to work diligently and was invited to join Level 1 as an equity Partner. I now own the Firm equally with Simon Long, Scott Wright and Lee Holmes, who have all been with Franklins for many years and progressed their careers within the Firm.

In my role as Partner I head up the Business Services offering and oversee the Corporate, Commercial, Employment and Commercial Property departments that provide services to the Firm’s corporate clients.

There is no “typical” day for me. In addition to my role as Head of Business Services, I also look after HR, Marketing and I am the Trainee Supervisor so in addition to speaking to clients in relation to a sale or an acquisition of a business I can be making decisions about marketing or recruitment.

I love the fact that my job is very diverse. I get to be involved in many things in relation to the running of the business and speak to lots of people. I’m also able to do what I enjoy most which is corporate transactions.

The biggest challenge is fitting everything into the working day that I need to complete. I would also say that recruitment and staff retention is becoming increasingly challenging because recruiters are constantly calling our employees and trying to entice them to new pastures. In many respects, this is an opportunity to ensure that our offering to employees remains competitive.

People sometimes ask me why I have chosen to stay with Franklins for over 20 years. I’ve worked with many people over the years who have left and discovered the grass is not always greener. I like the work that I do and the people that I work with. Many people that I have trained have stayed with the Firm and it is rewarding to know that you are contributing to the growth and success of the business.

When I’m outside of work, I enjoy running. Although I recently slipped two discs so I’ve been out of action but I can’t wait to get back to marathons again. These days I spend time in the pool doing hydrotherapy exercises. I also spend time with my children and my puppy Woody.

For further advice and assistance please contact our Business Services Team on 01604 828282 / 01908 660966 or email info@franklins-sols.co.uk

Holly Threlfall joined Franklins in 2013 and has since worked her way up to becoming a Corporate Partner in our Business Services Department. Here she explains what the work involves and what she enjoys about her role.

Being a Partner in a law firm has its ups and downs like any other job. It can involve long hours, tight deadlines and stressful situations. However, it can also involve great clients, exciting deals and an extremely variable ‘day at the office’.

No two days are ever the same. I have been at Franklins for nearly 9 years and I can comfortably say that every day brings something new. My clients come from different backgrounds, from retail through to construction, manufacturing, professional services and even aerospace. This certainly keeps me on my toes, as every piece of work needs to be tailored to each of my clients and their industry needs. The nature of work that I undertake also varies from day to day. One day, I may be focused on drafting a Share Purchase Agreement which can involve several hours of technical drafting, the next I may be reviewing due diligence documents to advise on the risks of acquiring a business and then I may be into a completion meeting or conference with clients to talk through their business needs before working into the evening to finalise points discussed throughout the day. These long, and sometimes intense, hours however are all worth it for a happy client and can be alleviated by working with a great team.

One of the best parts of my job is the people that I work with. We have a team of Partners here at Franklins each with their own expertise to support our clients with their various needs. Then there are the other solicitors, trainees and support staff, all of whom play an essential role to look after our clients. I wouldn’t be able to do my job if I didn’t have the support of my assistants, the reception and compliance team, accounts team, marketing and other members of the firm all of whom work together to deliver our services. That is not to say that we are always perfect (although we do try!). We will always do our best to look after our clients and keep the firm moving forwards.

Of course, as a Partner one of the key parts of my role is supporting my team and training the next generation of lawyers. I work closely with newly qualified solicitors, trainees and paralegals to pass on the knowledge I have gained from my own experiences. From technical understanding and advice, through to transaction and case management and essential skills such as communication skills, much of my days can be spent working with the junior team to help them grow and develop into the next generation of solicitors.

But it’s not just the team at Franklins that I work closely with. One of the most rewarding parts of my job is working not only with some great clients, but also other professional advisors who are essential in ensuring our clients’ interests are best served. It’s not unusual to have several calls a day with the same clients and advisors over several weeks as a deal intensifies. You get to know everyone personally and these relationships only grow over time which makes it even more rewarding when a deal completes. There is no better feeling than a grateful client, happy with the outcome of their transaction and ready to move onto the next chapter of their journey, be that growing their business or retiring to enjoy the fruits of their labour!

Despite the many roles I fill, busy days and sometimes long hours required, life as a Partner does not mean that my work is my life! I have a great work-life balance, which is supported and made possible by my team and other partners. I can squeeze a run or swim in before work, play badminton on a regular basis and bake celebration cakes for my friends and family (or just because I want to!) when the need arises. Baking is a particular passion of mine and I do love to challenge myself to come up with new and creative cake flavours and designs – something which often surprises many people when they discover that I am a corporate lawyer!

Whilst corporate law can have a reputation of being ‘dry’, my experience as a solicitor and Partner at Franklins is anything but. My day is filled with a variety of challenges; my life enhanced by the variety of relationships and friendships that I have formed throughout my career.

To contact Holly or a member of the Business Services team, please call 01604 828282 or 01908 660966 or email info@franklins-sols.co.uk.

Starting a business shares some similarities with marriage in that often, partners think that everything will go perfectly well and that they will  never face any issues in their relationship. For this reason, people often neglect to put in place a Shareholders Agreement. Unfortunately, disputes can arise in both romantic and professional relationships as interests diverge. Although nobody should enter into a relationship thinking that it will fail, sadly people do fall out and Shareholders Disputes have become increasingly common.

never face any issues in their relationship. For this reason, people often neglect to put in place a Shareholders Agreement. Unfortunately, disputes can arise in both romantic and professional relationships as interests diverge. Although nobody should enter into a relationship thinking that it will fail, sadly people do fall out and Shareholders Disputes have become increasingly common.

What Disputes can arise?

Disputes can arise for many reasons over time and vary from business to business. In some cases, the Shareholders simply cannot agree the best commercial strategy. In others, a Shareholder may go AWOL or there is a disproportionate amount of time, effort and resources being put into the business. In more extreme circumstances, shareholders have stolen from Companies or set up in competition with the business. Sadly, I have seen all of these arise at different points in a Company’s lifespan and they end up being complex and costly to resolve. What’s worse, is more often than not escalation could have been prevented by having in place a Shareholders Agreement.

What is a Shareholders Agreement?

A Shareholders Agreement is a private contract which regulates the relationship between shareholders. It can contain clauses such as:-

– Duties and obligations on shareholders. These can be broad, such as an obligation to act fairly and in the best commercial interests of the business, or narrow such as agreeing not to undertake certain actions without consent.

– Limitations on when and how you can transfer shares, including giving a right to buy shares from a shareholder in certain circumstances such as death or incapacity.

– Restrictions on the parties to prevent competition and keep company information and trade secrets confidential.

– A dispute resolution mechanism which details a process that is followed to resolve a dispute, and what happens if it can’t be resolved.

Ultimately, it is a bespoke agreement that can be tailored to your needs. It is strongly recommended to have a Shareholders Agreement in place whenever you have multiple shareholders. This is regardless of the strength of friendships and the nature of relationships between shareholders.

What happens if I don’t have a Shareholders Agreement?

If you don’t have a Shareholders Agreement, disputes often become protracted as there is no foundation for your relationship as shareholders. The aim of course is to avoid litigation as it will incur more costs, take time and it will ultimately cause a lot of stress to all parties.

When seeking to resolve a dispute, it is important to try to understand the other party and why you are in this current situation. You should always try to negotiate between yourselves before starting legal proceedings. If unfortunately, this does not work, mediation is an option. The mediator will attempt to control the negotiation process and facilitate the discussions between each parties with a view to them reaching a consensus on how to proceed. Whether you negotiate or mediate, the outcomes will vary for each dispute but generally they could include:

1) One party selling or transferring their shares to the other party for a fair price

2) Winding up the company

3) Continuing the business but under a new agreed strategy – which in itself may involve putting in place a Shareholders Agreement!

There is no one-size fits all approach to resolving a dispute. A successful outcome is often dependant on the parties’ willingness to come to the table and negotiate or mediate. In some circumstances, litigation may be appropriate.

If you do find yourself in a shareholder or director dispute without an agreement, our Dispute Resolution team of course can be on hand to assist. However, if you are fortunate enough that you are in a place to negotiate a Shareholders Agreement, my advice would be the age-old adage, prevention rather than cure.

For advice in relation to shareholders agreements, contact the Corporate Team on 01604 828282 / 01908 660966 or email Corporate@franklins-sols.co.uk

Cynthia Spencer Hospice is challenging local businesses to take part in the £45 Accumulator Challenge sponsored by Franklins Solicitors LLP, and raise as much money for charity as possible from an initial investment of £45.

Corporate partnerships fundraiser at the hospice, Nina Gandy said: “Our £45 Accumulator Challenge starts on 6th September and during its 8 week run, gives businesses the opportunity to have fun and fundraise at the same time. Previous participants have raised money through team-building and networking events and have come up with many creative ways to grow their start-up so we’re hoping to see some great ideas, particularly now businesses are able to network and their staff are able to return to the office.

“We’re hoping the teams who have signed up this year will come up with even more ingenious ways to fundraise for our patients and their families while maximising opportunities for their own businesses too. We’ll provide plenty of collection buckets and branded items and of course we’re on hand with fundraising tips as well as providing PR coverage for the teams taking part so the sky’s the limit really!”

One team taking part in this fundraising challenge for the first time is Ballyhoo PR. Director Emma Speirs commented: “We’re really excited to be taking part in the £45 challenge to celebrate 45 years of Cynthia Spencer Hospice and raise funds for the charity at the same time. We wanted to take part to show our support for the hospice and also to be a part of something taking the local business community by storm!

“We are looking forward to working together as a team and putting our creativity and entrepreneurial skills to the test to see how we can grow our £45 into even more money for this fantastic hospice.”

Andrea Smith, Partner & Head of Business Services at Franklins Solicitors LLP, said: “Franklins are delighted to be sponsoring Cynthia Spencer Hospice’s £45 Accumulator Challenge. For 45 years, Cynthia Spencer Hospice has provided invaluable physical, psychological, social and spiritual support to the local community in Northamptonshire and after an immensely tough year, we’re proud to be supporting the hospice to help them continue to provide this much needed care.

We hope that local businesses will use Accumulator Challenge as an opportunity to reconnect, have fun and above all raise as much as they can for Cynthia Spencer in celebration of its 45th birthday”.

The hospice fundraising team is still taking registrations for teams to join the challenge so any businesses or networking groups who wants to put their entrepreneurial skills towards raising money to support end of life care in Northamptonshire can sign up by contacting Nina by email on nina@cynthiaspencer.co.uk or by calling 01604 973348. More information can be found by visiting www.cynthiaspencer.org.uk/event/accumulatorchallenge2021.

Photo by Christina Morillo from Pexels

Buying a business is an exciting time for any entrepreneur. However, it can also be a significant risk as more often than not you put either your money, or other personal assets, on the line and whilst with great risk can come great reward, this isn’t always the case. Once you have your team together, a target in mind and know the structure of the transaction, it’s good to understand the stages of buying a business.

Buying a business isn’t the same as your average property conveyance, although the process may appear similar as it involves due diligence and enquiries, a contract for sale, exchange and completion.

Heads of Terms

One of the first documents you will need to agree is your Heads of Terms. These set out the headline terms for the deal and should accurately represent the parties’ agreement and on what basis they are willing to proceed. Whilst on the whole these are not legally binding, there are some provisions which will be including confidentiality and exclusivity. Therefore, it is important to ensure that these are fairly drafted and that you are fully appraised of what you are committing to before proceeding.

Due Diligence and Enquiries

Once you have Heads of Terms signed, you will need to undertake legal due diligence enquiries. This is a series of questions about the business you are buying, its assets and historic trading position. There are usually 4 limbs to these enquiries 1) Commercial (so that you have a full understanding from an operational perspective how to run the business once you take control) 2) Accounts (so that you are fully appraised on the basis upon which the company accounts for its income and to ensure that the expected income from your investment aligns with the accounting principles adopted by the Company) 3) Tax (so that any tax risks, anomalies or filing issues with HMRC are picked up and can be addressed as a part of the transaction) 4) legal – these are especially important as they address how the business has been conducted to date with a view to flagging any risks and liabilities associated with the business you are buying or structure of the deal.

Legal Documents

Once you have a comprehensive understanding of the business the paperwork to govern your transaction can be prepared. This will consist of a series of legal documents from your sales contract (which may take the form of a Share Purchase Agreement or Business Sale Agreement depending on your structure) through to a Disclosure Letter and ancillary documents required to effect your transaction itself. These need to be carefully drafted and negotiated to ensure that they comprehensively reflect your deal and minimise the risk to you.

Exchange and Completion

Once the legal documents are in agreed form, the final stage in your transaction is exchange and completion. Exchange and Completion is often simultaneous in these deals, so the point where you are legally bound is also the point where you get the keys to the business. This does mean that it is quite common to be negotiating to the wire – but an experienced team behind you will not only have the skill, but the stamina, to handle this!

Post-Completion

What happens after completion is just as important as the preceding stages to make sure that all necessary formalities are attended to. This includes payment of stamp duty where due, filings at companies house and updating Statutory Books where necessary. An experienced legal team will be able to attend to this and support you where necessary with any queries that you have on what is needed to finalise your deal.

For advice in relation to buying a business, contact the Corporate Team on 01604 828282 / 01908 660966 or email Coporate@franklins-sols.co.uk.

Buying a business is an exciting time for any entrepreneur. However, it can also be a significant risk as more often than not you put either your money, or other personal assets, on the line and whilst with great risk can come great reward, this isn’t always the case. Before proceeding with your investment, you should make sure that you understand the process, what you are buying and crucially have a team around you that can support each element of your transaction.

Photo from Pexels

Once you have your team together and a target in mind, you will need to consider the structure of the transaction and how you are going to work the deal. There are several different factors that you will need to consider:-

Asset Sale vs Share Sale

If the business you want to acquire is traded through a limited company, you could consider buying the shares in that company. However, this would mean that you take on both the assets and the liabilities of the Company indirectly. Therefore, before agreeing this route you should ensure that there are no liabilities that are particularly onerous or would not want to assume (for example historic tax claims) and that the business of the company comprises of the business you want to buy – i.e. there aren’t any other businesses operated through it which you don’t want to acquire. Due diligence therefore becomes particularly prudent if considering this route.

The alternative is that the company sells its business to you as a going concern. This can benefit you as a buyer as you cherry-pick the assets you want and don’t automatically assume liabilities unless you agree to take them on. However, this can have tax implications for a seller and it can be more complicated if there are particular assets or contracts that need to be transferred to you. For example, those subject to asset finance or material customer and supply contracts requiring consent. If this is the case, a share purchase may be more appropriate to ensure continuity of the business.

There is no ‘one size fits all’ in a transaction and it is important that you get the structure that is right for you.

Payment on Completion vs Deferred Consideration

Another key factor in a sale structure is when you will pay for the shares. Naturally, a Sellers preference would be for you to pay for the shares up front. However, there may be many reasons why this isn’t advisable. For example:-

- From a legal perspective, there is always the risk that what has been presented to you through the negotiations or warranted to you to induce you to proceed transpires to be untrue and gives rise to a claim. If this is the case, you would be better to be able to set-off the Seller’s liability due to you against the deferred consideration you owe them. Otherwise, you could end up chasing a debt you never realise.

- From an accounting perspective you may not have the cash to pay the entire purchase price on completion (as the purchase price may take account of more than the net asset value of the company and could factor in, for example, a multiple of EBITDA and potential future earnings). Therefore, it may be necessary to defer payment of some of the purchase price to enable the funds to be raised.

- From a commercial perspective, you may agree for the purchase price to vary depending upon whether or not certain targets are met and post-completion performance of the company. Therefore, this part of the purchase price would be deferred depending upon the outcome.

Post-Completion Adjustments

There are many different adjustments to the purchase price that can be made post-completion.

- The purchase price may be adjusted to reflect the actual net asset position of the Company on Completion or to take into account the cash in the bank (subject to any indebtedness and there being sufficient working capital) as at completion. These are commonly referred to as a ‘net asset adjustment’ or a ‘cash free/debt free’ deal.

- The purchase price could also be adjusted depending on post-completion performance of the Company, this could take the form of an ‘Earn-Out’ if the seller is staying on post-completion or even be a direct reduction if the Company’s financial position isn’t maintained, or conversely uplift if it performs!

- Ultimately, if there is to be any variation of the purchase price your documents have to be carefully drafted so that they are clear, concise and include accountability provisions and the ability for you to fairly challenge any variation.

The above are just some examples of structure variations that may need to be factored into your deal. At the end of the day, each transaction is unique and it’s important that you consider the structure with your professional advisors to ensure that it works for you.

For advice in relation to buying a business, contact the Corporate Team on 01604 828282 / 01908 660966 or email Coporate@franklins-sols.co.uk.