- Milton Keynes 01908 660966

- Northampton 01604 828282

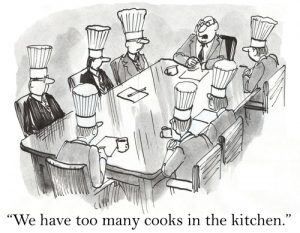

Yes, it seems so.

Recently the International Chamber of Commerce (“ICC”) released its statistics on Arbitration cases for the past 12 months. The results showed that in 2018, 842 new cases were registered with the ICC, involving 2282 parties from 135 countries and territories. The increase in the number of parties seeking Arbitration reflects the general trend reported by many of the other Arbitration institutions.

The statistics also showed increasing diversity in parties and arbitrators. Just under 41% of all parties to disputes filed with the ICC are based in Europe. Gender diversity of the arbitrators is now being published by some of the Institutions with the ICC confirming that 18.4% of confirmed appointments in 2018 were women.

Many disputes revert to Arbitration due to a contractual obligation to do so. Without such an agreed contract clause, the three popular means of resolving a commercial dispute remain litigation through the Courts, arbitration and mediation.

Time is considered a negative factor of litigation through the Court with the process often being criticised for taking years to complete. The average duration of ICC cases from start through to final award in 2018 was reported to be two years and four months. An award is the Arbitration Tribunal’s equivalent of the Court’s judgment. It is difficult to draw direct comparisons as with every arbitration there are occasions when the parties agreed to suspend and stay the process due to the flexibility that this type of forum offers. To expedite awards however, the ICC is seeking to limit any delays by offering expedited procedures to incentivise Arbitrators to draft their reward decision quickly post hearing. These measures allow the ICC to reduce Arbitrator’s fees when awards are not submitted within two months by a single Arbitrator or within three months by a three-member Arbitration Panel.

It is perhaps encouraging for some to note that the ICC has classified “younger” Arbitrators as those under the age of fifty and that younger Arbitrators made up 35% of the Arbitrators appointed in 2018.

If you have a contract dispute and your contract contains an arbitration clause, we can help.

For further advice and assistance please contact our Private Client Team on 01604 828282 / 01908 660966 or email info@franklins-sols.co.uk

Whilst many people have an understanding of the court process, arbitration is less well understood outside of certain sectors. Here’s an outline of some of the key facts.

Whilst many people have an understanding of the court process, arbitration is less well understood outside of certain sectors. Here’s an outline of some of the key facts.

What law applies to an arbitration?

The Arbitration Act 1996 applies to all arbitration that falls under the jurisdiction of England and Wales or Northern Ireland.

Are arbitration agreements enforceable?

If you have signed a contract specifying that any dispute between the contracting parties is to be resolved by way of arbitration, an English court is likely to uphold that agreement. This could therefore mean that any Court proceedings issued are stayed (put on hold) whilst the matter is referred to arbitration.

Can I challenge the appointment of an arbitrator?

Yes. Under section 24 of the Arbitration Act, it is possible to apply for the removal of an arbitrator on the following grounds:

• circumstances exist which indicate the arbitrator may be impartial;

• the arbitrator does not possess the qualifications required by the arbitration agreement;

• the arbitrator failed to conduct the proceedings appropriately;

• the arbitrator is physically or mentally incapable of conducting the proceedings;

• there are justifiable doubts as to his or her capacity.

In all of the above circumstances however there is a need to show that there will be “substantial injustice” caused as a result of the appointment.

The arbitrator will also be invited to comment on the objections. The Act permits the Court to make an order as to whether or not the fees of the arbitrator are paid in these circumstances or indeed if the arbitrator must repay any fees or expenses already received.

What obligations are placed upon arbitrators and what power do they have?

There are specific powers and also general duties imposed upon arbitrators.

As a general duty, the Tribunal must:

- act impartially and fairly between the parties and provide each side with an opportunity to present its case and deal with their opponents case;

- adopt appropriate procedures to ensure that they provide a fair means for resolving the issues between the parties thereby avoiding unnecessary delay or expense.

The actual powers of an arbitrator are often set out within the arbitration agreement itself. Those under the Act can therefore be amended by such an agreement but in general include the power to:-

- decide upon procedural and evidential matters

- appoint experts, legal advices and assesses

- order preservation of evidence

- rule on its own jurisdiction

- order security for costs

How do you start arbitration proceedings?

Often the arbitration agreement will set out what is required to start arbitration proceedings. In the absence of such an agreement, section 14 of the Arbitration Act 1996 says:

- if an arbitrator is named or designated by the parties in the arbitration agreement, proceedings are commenced when one party serves a notice in writing to the other party, requiring them to submit the matter to the person named.

- where an arbitrator is to be appointed by a nominated third party, proceedings are commenced when one party serves notice in writing to that third party requesting it to make an appointment.

Are there any limitation periods for the commencement of an arbitration?

Whilst there are no specific statutory limitation periods for the commencement of arbitration under the Arbitration Act, the agreement between the parties may set certain time-frames.

Normal limitation periods apply for commencing legal actions in the United Kingdom and therefore, for example, for contractual claims this will usually be 6 years from the date of the breach.

What evidence is presented to a tribunal?

A hearing before an arbitrator(s) is called a Tribunal. The evidence presented will depend upon what the parties have agreed. If the arbitration agreement between the parties is however silent on this point, the Tribunal has a discretion under sections 34, 43 and 44 of the Arbitration Act 1996. This will usually involve documentary evidence being attached to the pleadings, witness statements and expert’s reports. The Tribunal also has the ability to appoint its own legal or technical expert.

Is arbitration confidential?

There is an implied duty upon the parties and the Tribunal to maintain the confidentiality of the hearing and any associated documents as well as the final award. There are certain exceptions. The parties may also provide for confidentiality in their arbitration agreement.

Is the arbitration award decided by the Tribunal recognised?

Section 52(1) of the Arbitration Act 1996 specifies that the parties can decide upon their own form of award however if no agreement has been reached, the following are to be included:

- it must be in writing

- it must be signed by all arbitrators;

- it must contain the reasons for the decision reached

- it must state the seat of arbitration

- to must also state the date upon which it was made.

Is the arbitration outcome final?

An award is final and binding on both parties with the exception of circumstances in which the parties agree otherwise. This does not however affect the right of any party to challenge the award by a process of appeal or review.

What steps can be taken to enforce an award if a party fails to comply?

The award can be enforced by an application to the court to enter Judgment or for an order of the Court on the same terms as the award. This is in accordance with sections 66 or 101 of the Arbitration Act 1996. Following the order of the Court, this can then be enforced using all the means available to Court under English law.

For further advice and assistance please contact our Private Client Team on 01604 828282 / 01908 660966 or email info@franklins-sols.co.uk

There are statistics that state that 1 in 20 Directors of companies that went into liquidation, administration or receivership were later disqualified from acting as a Director.

There are statistics that state that 1 in 20 Directors of companies that went into liquidation, administration or receivership were later disqualified from acting as a Director.

The consequences of the disqualification extends further than just the role of Director.

The prohibitions also include acting as one of the following:-

- * Money Advisor

- * Financial Intermediary

- * Social Landlord

- * Local Medical Service Contract Provider

- * Local Dentist Service Contract Provider

- * Trustee of a Charity

- * School Governor

- * Pension Trustee

- * Member of the Health Care Board

- * High Court Enforcement Officer

There is also the risk of getting prosecuted in the criminal courts for breaching the disqualification order with a guideline sentence of 6 months immediate imprisonment for cases which do not involve dishonesty.

For those who perhaps thought there were shortcuts around the rules, they need to think again. Someone acting on the instruction of the disqualified Director, knowing of their disqualification can lead to both being personally liable for a company’s debts.

The rules do not apply if the individual becomes a sole trader and where therefore any liability is taken personally without the status of protection afforded by a limited entity.

For assistance in negotiating with the Secretary of State on the Undertakings before a disqualification order or for an application to the court to approve a specific role or appointment post disqualification, please contact our Dispute Resolution Team.

There have been many reported disputes relating to the inheritance of family farms. Such cases explore a legal doctrine that in itself offers little explanation in its own description: Proprietary Estoppel. Not every day terminology and yet the concept of relying upon a promise and suffering a detriment when it is broken is readily understandable by all. This particular case falls into that category.

The case of Tump Farm and a son excluded

Tump Farm was owned by David Guest. In the early 1980s, he and his wife, Josephine, left the farm in their Will in equal shares between their eldest son, Andrew, and their youngest son. A monetary legacy was left to their daughter which was equivalent to one-fifth of the net value of the couple’s residuary estate.

Tump Farm was owned by David Guest. In the early 1980s, he and his wife, Josephine, left the farm in their Will in equal shares between their eldest son, Andrew, and their youngest son. A monetary legacy was left to their daughter which was equivalent to one-fifth of the net value of the couple’s residuary estate.

In or around 2015, Andrew left the farm. He had worked there from 1982 and lived in a cottage within the farm grounds with his family until 2017. Relationships however soured and this led to his parents serving a Notice to Quit upon Andrew and his family and removing them from the cottage. The fall out came in part following Andrew’s decision to work elsewhere.

In 2018, David decided to make a new Will. The new Will excluded Andrew entirely and left the farm solely to Andrew’s brother with a lump sum of £120,000 and part of the land to his sister with a right of occupation for Josephine. David explained that his decision to exclude his eldest son was on the basis that he had “lost all Trust in him in” following his departure from the farm.

The challenge of the Will – Proprietary estoppel (a broken promise)

Andrew sought to challenge the Will and whilst ordinarily these types of disputes arise upon death, he brought a claim against his parents for proprietary estoppel – the broken promise upon which he had relied and suffered a detriment.

Andrew’s case was that he had over the years worked on the farm for only a basic wage and relied upon the promise from his parents that one day he would inherit the farm. He stated that he had chosen not to work elsewhere for a much higher wage in reliance upon his parents promise to him and as a result he had suffered a financial detriment and was only paid a basic wage whilst working on the family farm and now was losing his previously promised inheritance.

The Court found in Andrew’s favour. Andrew was awarded a lump sum equated to 50% of the farm and its land and 40% of the rest of the land and buildings on the farm.

The Court found that David had consistently led his eldest son to believe that he would succeed in the farming business. These assurances had continued over many years leading Andrew to rely upon them to his significant financial detriment.

These cases are decided on their own facts. Whilst the principles remain the same, the application to key facts are vital and make witness and supporting evidence even more important. In this particular case, the Judge heard recordings of conversations that had taken place between family members and these played a part in the findings.

For further advice and assistance please contact our Private Client Team on 01604 828282 / 01908 660966 or email info@franklins-sols.co.uk

The prospect of a new venture and becoming the owner of shares in a business is an exciting time for anyone in business whether new to acquisitions or an old hand at it.

The prospect of a new venture and becoming the owner of shares in a business is an exciting time for anyone in business whether new to acquisitions or an old hand at it.

Getting the deal done may sometimes come at a cost and relying upon warranties provided can be necessary when a company does not deliver all that was expected.

There are often clear time frames to bring a breach of warranty claim so getting to know the business quickly is important.

Is there a method of measuring damages for breach of warranty in a share purchase agreement?

Yes, this is the diminution in the value of the company’s shares. This established method was put to the test in the case of Oversea-Chinese Banking Corporation Limited v ING Bank NV [2019] EWHC 676 (Comm).

In this case, there had been a failure to provide for a $14.5 million exposure in the accounts. Not an insignificant amount of money to miss out! Perhaps surprisingly, the omission had no impact upon the valuation of the company and so reduction in the value of the company’s shares. The question was therefore whether the diminution was just part of the loss that could be claimed and if it were also possible to include an element of damage based upon the loss of chance to negotiate a specific warranty or indemnity during the pre-contract negotiations.

The Judge decided that there was this type of secondary loss had no place in law and that the purchaser had no right to claim for damages associated to an amount that could have been claimed under what would have been an indemnity created post contract for the purposes of the claim. Such an indemnity did not exist and as such no claim was recoverable. Instead the correct approach under well-established case law was that the claimant was entitled to be put in the position it would have been in had there been no breach of warranty, or to recover damages for its “loss of bargain” as a result of the breach. In these specific circumstances, there had been no reduction in the value of shares and therefore no loss of bargain had been sustained. It was not possible for the claimant to recover the $14.5 million loss.

It can be a challenge to establish that there has been a drop in share value as a result of a breach of warranty but this is the basis of the court’s assessment of loss in such cases.

If you entered into a Share Purchase Agreement and believe that there has been a breach of warranty, seeking early advice can prevent extensive costs being incurred that later prove not to be recoverable.

Every case is decided upon its own facts and therefore it is important to secure advice about your own separate circumstances.

For further advice and assistance please contact our Private Client Team on 01604 828282 / 01908 660966 or email info@franklins-sols.co.uk

Family owned businesses can suffer with shareholder disputes just like any other. In the case of Waldron & Others v Waldron & Another, the High Court considered the issues surrounding the conduct of a Managing Director of a family owned company and whether his Shareholder siblings had been unfairly prejudiced.

Multiple shareholders in dispute

Multiple shareholders in dispute

The company was owned by four siblings all of whom had inherited their respective Shareholdings from their parents. We have referred to the Company’s majority shareholder and Managing Director as A. In addition, B describes a minority Shareholder and Director and C a minority Shareholder and the Company Secretary. D was a minority Shareholder that was not actively involved in the running of the company. As well as the four siblings, a corporate entity known as SIG also held shares in the business.

A identified an opportunity to purchase assets from a separate business that had entered administration. To facilitate an acquisition of those assets, A incorporated a new corporate vehicle and hired the assets purchased through this new entity to the family business at an excessive charge. B and C alleged that A had entered into an arrangement in order to extract value from the family business. They alleged the excessive charge worked to their detriment.

A approached SIG to acquire its shares in the family company. The approach resulted in a breakdown in the relationship between the siblings over the proportions in which they should acquire the shares from SIG. A wanted to acquire all of SIG’s shares, whereas the other siblings argued that the distribution of those shares should be in proportion to existing shareholdings.

Communication between the parties became strained and a dispute arose which resulted in A restricting B and C’s email access to company business and B and C offering money to an IT consultant to provide them with access to A’s emails. A discovered that B and C had access to his emails and dismissed B and C as employees of the company based upon their divisive step to access his emails without his knowledge.

B and C claimed that A’s behaviour amounted to unfair prejudice. Relying upon the principle that a member of a company can ask the Court for relief (i.e. a solution to the problem) if the affairs of the company are being conducted in the manner that is unfairly prejudicial to their interests of a member. The case went to Court.

The Courts findings

The Judge found that A’s behaviour in authorising the lease of assets to the company was unfairly prejudicial as he had placed himself in a position of conflict of interest. A had failed to seek permission from the company for this conflict and therefore breached his Director duties. The Court found that even though A believed the arrangement would be of benefit to the company, this in itself was irrelevant.

However B and C had learnt of the hire arrangements soon after they were put in place and yet still did nothing about the arrangement at that time. The Court found that they had in effect acquiesced in the breach and this therefore prohibited them from making a later claim. The Court found this also applied to D who whilst unaware of the hire agreement had been content to leave the running of the company to her brothers.

Turning to the email access, the restriction of B and C’s email access according to the Judge had not amounted to unfair prejudice. The High Court Judge found that although a company’s board was entitled to full information about every aspect of the company’s affairs, a Director did not necessarily have automatic right to see all emails or documents generated in the course of business. He added that there may be circumstances where a Managing Director or Chairman needed to deal with matters confidentially.

In addition, A’s dismissal of B and C had also not amounted to unfair prejudice because there was good reason for their dismissal. Their attempt to bribe a consultant to provide unauthorised access to emails was, according to the Court, “manifestly improper”.

What can be learnt from this case?

This case from March 2019 is a reminder that a company’s covenants with regards to the declaration of conflict remains as important as ever. Even though the arrangement arising from the conflict of interest is of benefit to a Company it does not mean that it overcomes a breach of duty. Complying with the Director’s duties remains paramount.

Another lesson with this case was that a shareholder who feels the company’s business is being run to their detriment must act quickly. Sitting on their hands in full knowledge of the issues and allowing it to continue may push a Shareholder into a position whereby they lose the remedy that they would later wish to seek.

Further, Directors may not have unfettered access to all records relating to their company. Whether a Director is entitled to see a particular document will always depend on the nature of the document and the reasons for which the Director is asking to see it.

If you are in doubt regarding your obligations as a director or indeed your rights as a shareholder, seek early advice. This can avoid what can be a lengthy and costly dispute.

For further advice and assistance please contact our Private Client Team on 01604 828282 / 01908 660966 or email info@franklins-sols.co.uk

Whilst every mediation is different there is a general structure that draws the process together. The following tips align with this structure and are based upon a commercial dispute.

Whilst every mediation is different there is a general structure that draws the process together. The following tips align with this structure and are based upon a commercial dispute.

Read the Mediator’s briefing notes

Most mediators will speak to those attending the mediation beforehand and provide an outline of the day as well as details of any papers that it would be helpful to provide beforehand. There is usually a deadline for providing any documents and it helps to ensure that the Mediator has all the information requested.

Check the Mediation Venue directions and parking

Coming up to settling your dispute at mediation can be stressful enough and therefore providing yourself with all the information as to how to reach the venue for the mediation and where to park is something you can control and that can ease the pressure on the day. Prepare for a long day – if using a pay and display car park, it can be helpful to pay for the full day rather than have to rush back to put in more money or worse, forget and end up with a parking ticket. If there are closing times for the car park, take a photo on the phone and add a reminder before leaving the car park so you can retrieve your car at the end of the day. There is nothing worse than being thrilled to have settled your dispute only to find that the lateness of the hour means your car is locked in a car park!

Make arrangements for business and family commitments to have support throughout the day without you

This isn’t always possible, but you have a chance to resolve a dispute that has the potential of running on into the future if unresolved. Committing to and investing time on the day of the mediation could be key to resolving the dispute, which has the potential to impact upon time and money in the future if it continues. This may mean that you have to make arrangements for children to be collected by a family member or friend or for extra cover at the office and in your business. By reducing your commitments on the day and therefore enabling your focus to remain on the task in hand can make all the difference.

Prepare a Case Summary and Opening Statement

You may be asked to make an opening statement in a joint mediation meeting. If so, this can be read out and therefore can be prepared beforehand if you wish. It can you the opportunity to focus upon what is important to you and also ensure that you do not miss anything out or show your determination and resolution in the dispute. Please refer to our previous Blog on how to prepare an opening statement.

Risk assess your case and have a negotiation plan

There are always risks with even the most certain of cases. If you cannot see the risks in the evidence, you will inevitably be facing a loss of management time and costs – both of which are worth avoiding. Reviewing your best and worst case scenarios, as well as understand what your best and worst alternatives to a negotiated outcome are, will provide you with insight and information as to what you want to achieve at mediation and your parameters for settlement. Preparing these beforehand will enable you to focus on the day on your goals and objectives and also balance any new information that comes to light during the mediation with the background information you already know.

Ensure you have or have access to all the information you need

It is important to take along to the mediation all the information or documents that you believe will assist you in presenting your position. These may or may not be used, however having them available will ensure that you are ready should anything be needed.

Occasionally the unexpected happens at a mediation and at those times it can be helpful to have someone at the end of the phone to access any additional information or expertise. If possible, have that person on call should you need them. It could be an accountant if there are financial matters to discuss or even an expert that can provide opinion or comment on information you have received so you can make an informed decision. Having at least a couple of telephone numbers for any such contact as back up ensures that your support network and team can produce any further details required enabling you to concentrate on the matters at hand and access advice should you need it.

Take refreshments

It can be a long day and refreshments are generally available. However this is not always the case, so going prepared with food and drink or change to enable you to buy something to keep you going during a long day will be key to keeping your energy levels up and to sharpen your concentration. There can be quite a bit of waiting around and whilst you are likely to have tasks to consider during these times, taking along something to read or do could be helpful.

Organise Arrival times

If you really do not wish to meet the other party in the dispute as you are arriving at your venue and being directed to your private meeting space, speak with the mediator to agree different arrival times.

For further advice and assistance please contact our Private Client Team on 01604 828282 / 01908 660966 or email info@franklins-sols.co.uk

The case of MacDonald v Rose [2019] EWCA Civ 4 brought to the forefront the key elements of the doctrine of proprietary estoppel. The case lends itself to being memorable in the future by many law students as it relates to Mr Macdonald and a farm.

A contested Will and a family feud

A contested Will and a family feud

Mr MacDonald brought a claim before the courts on the death of his parents and after he discovered that the family farm was to be split between his parent’s six children and not left solely to him.

Mr MacDonald claimed that his parents had assured him over many years that he would receive the bulk of their estate on the basis of him continuing to work on the family farm during their lifetime. He claimed therefore that he worked on the family farm in reliance of these assurances and that it was unconscionable for his parents’ estates not to give effect to those assurances. His five siblings objected and sought to uphold their parents will which saw the assets split across all six children.

The siblings, the defendants, told the Court that they were a close-knit family. They added that no child was ever favoured above and beyond another. In addition, they stated that each sibling had been told on several occasions that they would all share in the estate. The Court heard from numerous witnesses, including non-family members, all of whom provided an account of events strongly supporting the defendants’ position.

The Court found that the substantial witness evidence produced by the defendants was persuasive. The Judge noted that Mr MacDonald had run his own successful business and that during this time had not worked on the farm. The Judge considered that it could not therefore have been the case that as a family member he had worked his whole life on the farm for little recompense. The Judge concluded that Mr MacDonald’s parents had not given the assurances as alleged and the case was dismissed. The Court of Appeal reviewed the matter and upheld that decision.

The proprietary estoppel – A promise

This case saw the Court consider a legal doctrine known as proprietary estoppel. There are 4 elements to proprietary estoppel; namely:

- A promise

- An act in the reliance upon the promise

- A detriment suffered

- The unconscionability of the position

A claimant must show that there was a promise made to them. The actions of the claimant must then be to rely upon that promise. When reasonably relying on a promise made, the claimant must show that they have suffered some form of detriment. Finally, it must be unconscionable for the promisor to be permitted to retract his or her promise.

A Court determines how best to satisfy what an equitable right is when a claim is established. It is a matter of justice being seen to be done.

Each case is decided upon its own individual facts. The MacDonald case demonstrated that it is necessary to show that all the elements of proprietary estoppel are connected and that witness evidence can be critical.

For further advice and assistance please contact our Private Client Team on 01604 828282 / 01908 660966 or email info@franklins-sols.co.uk

For the majority of law-abiding Directors the issue of personal liability for their actions and decisions taken on behalf of a company rarely crops up. However, in the recent case of Antuzis & Ors v DJ Houghton Catching Services Limited & ORS [2019] [EWHC 843] [QB] this general rule has been shown to change significantly when the conduct of the Directors is deemed unlawful.

For the majority of law-abiding Directors the issue of personal liability for their actions and decisions taken on behalf of a company rarely crops up. However, in the recent case of Antuzis & Ors v DJ Houghton Catching Services Limited & ORS [2019] [EWHC 843] [QB] this general rule has been shown to change significantly when the conduct of the Directors is deemed unlawful.

This particular case involved a group of Lithuanian nationals who travelled to the UK having been promised work. Whilst the work materialised, they were subjected to appalling employment conditions.

They worked excessive hours, they did not receive the minimum wage, they did not receive holiday pay, and they were required to sleep in the back of a minibus whilst being transported between farms where they worked as chicken pickers. Visiting inspectors reviewing the gang master licences of their employer were provided with doctored timesheets, which dramatically understated the number of hours worked and the entire operation typified the reason why gang master licences were brought into effect to protect labourers from what the High Court found to be “gruelling and exploitative” conditions.

What duties must Directors comply with?

Under the Companies Act 2006, Directors must comply with a number of duties. Two specific duties were identified in this case as follows:-

- The duty to promote the success of the company [section 172]:

“a Director of a company must act in the way he considers, in good faith, would be most likely to promote the success of the company… And in doing so have regard to: [a] the likely consequences of any decision in the long term; [b] the interests of the company’s employees… [d] the impact of the Companies operations on the community and the environment; and [e] the desirability of the company maintaining a reputation for high standards of business conduct”

- The duty to exercise reasonable care, skill and diligence [section 174]:

“a Director of a company must exercise reasonable care, skill and diligence…”

The focus of the legislation is upon a Director’s conduct and approach to fulfilling his duties in association with the company as opposed to a third party. In this particular case, the Judge considered the facts presented to him and specifically the credibility of the Directors involved when giving evidence.

Make sure you understand what your personally liability as a Director

The High Court found that the Director and Company Secretary, who was bound by similar duties to act in the company’s best interests, failed to act in accordance with their duties towards the company in compliance with the above Act because they did not honestly believe that they were paying the minimum wage, overtime and holiday pay and further that they were entitled to make deductions and withhold payments for accommodation costs and work finding fees.

As a result, it was held that they had induced the company to commit statutory breaches of employment law which led to the ruin of the reputation of the company as well as the loss of the gang masters licence which was required to employ workers and run the business.

By the time this matter had reached Court, the company had reduced size from one of the biggest chicken catching operations in the South of England to effectively a one man band. As a result of this dramatic downsizing, the claimants faced the prospect of little chance of recovering anything from the company itself making the recover from the Director and Officers of the company personally vital. These were not your average Directors trying to go about business on behalf of a company in good faith. The judgement is littered with dismissive references to their credibility with the Judge calling their evidence “totally bizarre”, “obvious untruths”, “hopeless and devoid of merit” and “nonsense”.

In his Judgment, the Judge stated: “I am in no doubt whatsoever, having heard the evidence, that both of them actually realised that what they were doing involved causing [the company] to breach its contractual obligations towards the claimants. What they did was the means to an end. There is no iota of credible evidence that either [of the] defendants possessed an honest belief that what they were doing would not involve such a breach.”

With such damning findings, the officers of this company were found to be personally liable for inducing the company to breach the employment contracts of the claimants.

Whilst not imposing personal liability for every breach of an employment contract by an officer of a company, this case applies a common sense approach to a situation in which there has been an unlawful and deliberate attempt to exploit third parties with the obvious consequence of being detrimental to the company itself.

For further advice and assistance please contact our Private Client Team on 01604 828282 / 01908 660966 or email info@franklins-sols.co.uk

During fraught exchanges, it is easy to miss the requirement to serve notice in the specific manner set out in your contract. Yet it is crucial and the Courts continue to address the point consistently when cases on the service of notice are heard.

During fraught exchanges, it is easy to miss the requirement to serve notice in the specific manner set out in your contract. Yet it is crucial and the Courts continue to address the point consistently when cases on the service of notice are heard.

In the case of GPP Big Field LLP & Anor vs. Solar EPC Solutions SL [2018] EW HC 2866 the Court considered a claim for liquidated damages and whether a damages clause constituted a penalty and in doing so highlighted the consequences of failing to give notice in the prescribed manner.

The case:

Prosalia UK Limited was engaged by GPP to construct solar power generation plants across the UK. Prosalia fell into insolvency and the contracts were assigned to its guarantor, Solar EPC Solutions. GPP brought a claim against Solar for the delay in the power generation plants being commissioned in accordance with the timescales set out in the contracts.

How many contracts?

There were in fact five contracts which had to be assigned and in relation to one of those contracts, Solar raised an argument that objections from local residents amounted to a force majeure event resulting in Prosalia being entitled to an extension of the time to commission the generation plant.

The contract specified that the party seeking to argue a force majeure event was required to give notice to the other party.

The Court held that because the contract contained specific notice requirements, notice of a force majeure event had to comply with these. Unfortunately Prosalias’ notice had not complied.

Always make sure you are aware of a contracts terms

This is a good reminder that where a contract specifies certain notice requirements, all notices served under that contract must comply with the requirements. It is important that all concerned in the contract and project management are fully aware of the contract terms and refer back to them. Failing to comply could result in being prevented from pursuing a claim that is conditional upon the service of a valid notice.

For further advice and assistance please contact our Private Client Team on 01604 828282 / 01908 660966 or email info@franklins-sols.co.uk