- Milton Keynes 01908 660966

- Northampton 01604 828282

As a corporate lawyer a fundamental aspect of the work that I undertake on behalf of our clients is the acquisition of shares in a company. Having carefully structured the requisite documentation providing for a successful purchase, the work does not end there. Post-acquisition, the focus shifts to the governance of the company moving forward and ensuring that the success of the company is always at the forefront of its shareholders minds. Therefore, just like the carefully structured transactional documentation effecting the purchase of the company, consideration should be given to the preparation of a carefully structured Shareholders Agreement.

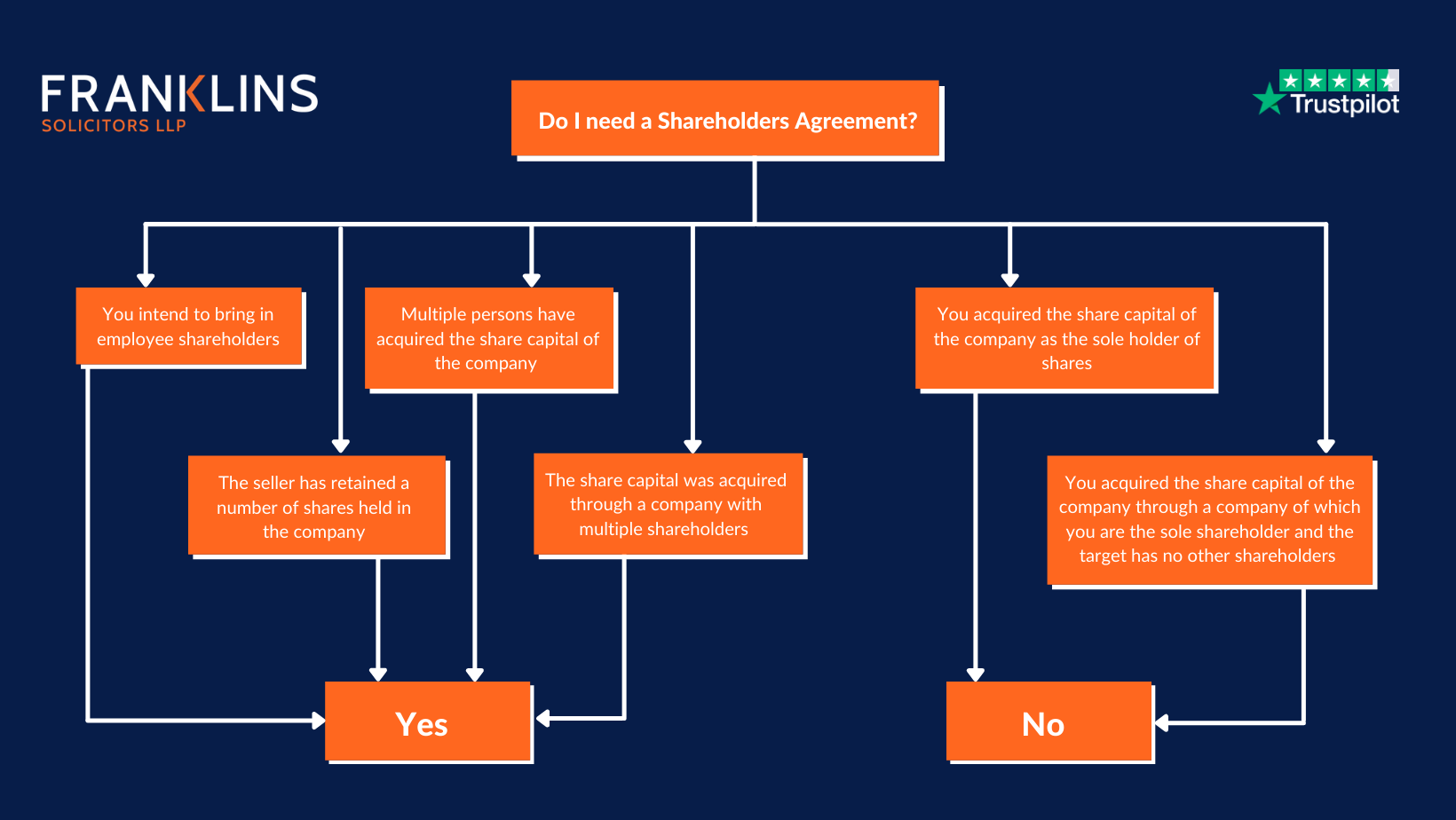

Do I need a Shareholders Agreement?

A Shareholders Agreement is always recommended where you have multiple shareholders. This is irrespective of any familial relations, friendship or pre-existing ties that the shareholders may have. As you will see, a Shareholders Agreement is key to ensure that each shareholder is accountable for keeping the company’s interests at the heart, and in the case of connected shareholders it can underpin that separation of ‘business’ and ‘pleasure’ that can easily be lost when running a company together.

Do I need a Shareholders Agreement flowchart

Having established whether a Shareholders Agreement is appropriate for you and the share structure of the company, the question turns to what is a Shareholders Agreement?

What is a Shareholders Agreement?

Engage with a corporate lawyer at any stage of your corporate journey and no doubt they will ask you whether you have a Shareholders Agreement in place – but what actually is a Shareholders Agreement and how will this help promote the success of the company?

A Shareholders Agreement is a private agreement between the shareholders of the company whether that consists of multiple individuals, multiple corporate entities or a parent company with multiple shareholders. The agreement binds them to certain provisions balancing their individual interests and that of the company whilst offering a solution to resolve any issues encountered in a clear and amicable way.

Whilst there is no legal requirement for you to have a Shareholders Agreement in place, from experience there will be times when the shareholders reach an impasse and are unable to reach a solution and my first question is always “Do you have a Shareholders Agreement?”. Unfortunately without the presence of a Shareholders Agreement there is no easy solution and costly litigation often follows.

“Prevention is always better than cure.”

What is included in a Shareholders Agreement?

Each Shareholders Agreement is different and should be tailored to your own needs. When I am assisting clients with their Shareholders Agreements, it is important to get to know the company, its nature, the structure and how the shareholders intend to deal with the internal affairs of the company.

Whilst the Shareholders Agreement can provide a solution to resolve any internal disputes and how these will be resolved, it also cover the internal affairs and management of the company with a view of promoting the success of the company – these could include:

- provisions for restricted decision making so that it is agreed that certain decisions will require majority or unanimous consent

- the type of business which the company can undertake

- access to financial information for all shareholders

- restrictive covenants and confidentiality provisions to protect the goodwill of the company

- transfer provisions to prevent shares being transferred to third parties without first being offered to other shareholders

- ‘Deemed Transfers’ so that in certain circumstances (such as bankruptcy and death) there is a notice deemed to have been served to the continuing shareholders and the company so that they can purchase shares from the effected shareholder

- rights of minority shareholders to tag-along with a third party offer to purchase share capital held in the company

- rights of majority shareholders to drag-along minority shareholders in a proposed share capital sale to a third party

- rights of employee shareholders – including good/bad leaver provisions in the event the employee leaves the company

The above mentioned points are only a summary of the key provisions that I would expect to see in a well-structured Shareholders Agreement. However, as I mentioned above every company is unique and it is important that you make sure that you have an agreement that is tailored to you.

If you would like to discuss whether or not you need a Shareholders Agreement and what is included, contact Robyn Jefferies and the Corporate Team on 01604 828282 / 01908 660966 or email Corporate@franklins-sols.co.uk.

Whilst many companies, together with their shareholders and directors are navigating the continuing disruption of the COVID-19 pandemic, some have made the decision that now is an opportune time to sell the business. What do buyers need to consider when pursuing a new opportunity at this time?

Whilst many companies, together with their shareholders and directors are navigating the continuing disruption of the COVID-19 pandemic, some have made the decision that now is an opportune time to sell the business. What do buyers need to consider when pursuing a new opportunity at this time?

The concept of “Caveat emptor” meaning “buyer beware” is integral to the approach to an acquisition and undertaking the due diligence process is one of the most crucial elements of the transaction Buyers must ensure that they are fully aware of all/any potential skeletons that may be lurking in the closet to expose risks and liabilities. Government imposed lock downs as well as global restrictions caused by the pandemic, coupled with social distancing rules have caused unprecedented disruption to businesses. This makes the due diligence process more important now, than ever.

The due diligence process is largely bespoke, by raising enquiries specific to the target company, its business undertaken and the particular industry or sector in which the company operates within. In terms of COVID-19, buyers will want to consider the following enquiries:

Contracts

Every company in some way will have been affected by the COVID-19 pandemic, which would have a knock on effect on the relationships they hold with their customers and suppliers. Buyers will want to analyse whether the target company is able to perform their obligations under existing contracts or if there is a potential that another party is not in a position to carry out their obligations thus affecting the company. In the event that a contract has been terminated and invoked any force majeure rights, the Buyer will want to analyse what impact this will have on the target company to continue operating in the ordinary course.

Compliance

COVID-19 triggered emergency changes in law and regulations and implemented new initiatives with the aim of protecting against the effects of COVID-19. Consideration should be given to whether the company has been compliant with these changes and whether any element of the company’s business or sector is restricted in any way as a result of the changes implemented.

Data Protection

Whilst working remotely and having employees working from home in response to COVID-19 may have its benefits, there is a heightened risk when it comes to Data Protection. What has the company put in place to reduce the risk of a breach of Data Protection or potential cyber-attack? Has the company experienced any issues which if not dealt with could result in a breach? In view of new working practices the company should review policies in place for its employees.

Employment

Inevitably the pandemic will have affected those employed by the company, whether this is through absence as a result of isolation from contracting the virus or due to a health condition which puts them into the clinically extremely vulnerable or clinically vulnerable categories. Has this impacted the business of the company? Have health and safety procedures to ensure a safe working environment been put in place for those who cannot work remotely? Are there policies for employees to work remotely from home? Has the company had to make the tough decision to make any of its employees redundant or furlough its employees?

Finance

Whilst COVID-19 triggered emergency changes in law and regulations, financial schemes and other measures were put in place to support UK businesses to protect them against financial issues as a result from the pandemic. Consideration should be given to what financial support has been obtained and whether this has been accounted for in the appropriate manner or what support is the company eligible for which can be obtained following the completion of the transaction.

Insurance

To protect the business a company may have sought to claim against their insurance policies, in particular claiming for business interruption losses as a result of COVID-19. Enquiries will need to be raised to ensure that the claims have been properly dealt with and whether as a result of such a claim this has affected the insurability of the company in the future.

IT Systems

With new working practices implemented for the foreseeable or even the new normal for the company, can the company’s IT infrastructure deal with and support secure remote working. Has the company needed to increase the licenses held or review terms of any of its licenced software? Are there any issues with the IT infrastructure which will hinder the ability to have increased demand as a result of the pandemic?

Tax

The buyer should always seek to understand the tax position of the company and the extent of any potential exposure of risk to the company. In view of changes to law, regulations and implementation of financial assistance as a result of COVID-19 it is more prevalent to understand the additional tax risks the company may be exposed to as a result of obtaining assistance during this unprecedented time. Whilst we cannot advise on tax issues, additional enquiries should be raised and responses on the same can then be discussed with your accountant or financial advisor.

The above mentioned points of consideration are by no means an exhaustive list, the intention of the due diligence process and the questionnaire is to ensure that the buyer knows every detail about the company, big or small, good and bad every cupboard should be checked.

The due diligence process is not just a benefit to the buyer, but in turn protects the sellers position by giving the buyer actual knowledge and negates the sellers liability for any potential breach of warranty, which has been negotiated under the requisite agreement in play to govern the testosterone gel stacking oriental testosterone transaction. Whilst the due diligence process is generally undertaken at the start of the transaction, more companies are deciding to undertake the process prior to the point of a sale being negotiated. This not only ensures the company, its shareholders and directors are prepared for the process, but helps to identify and take any necessary action to address those identified points that need dealing with, such as ascertaining ownership of intellectual property or reconstituting statutory books.

If you are interested in buying or selling a business and would like more information in relation to the Due Diligence process then please do not hesitate to contract our experienced team on 01604 828282 / 01908 660966 or email BusinessServices@franklins-sols.co.uk.

Whether you are lending money to a friend or family member in times of financial hardship or investment into a new business venture, have you considered what would happen in the event that the agreement between you both is dismissed?

Whether you are lending money to a friend or family member in times of financial hardship or investment into a new business venture, have you considered what would happen in the event that the agreement between you both is dismissed?

Relationships between friends and family members at the best of times can be testing, adding what can be the most contentious element there is, “money”, to the mix and you are gearing up for a whole host of problems.

When lending between friends and family members consideration is often not given to what might happen in the event that;

- the borrower fails to repay the loan as initially agreed between you both

- the borrower recalls the terms of you advancing the money to them differently to you and considers the money as a gift

- the relationship breaks down and you are no longer on talking terms

- the borrower dies

What may seem unnecessary and too formal, a Loan Agreement protects both you and the borrower from any unforeseen issues and avoiding quarrels in the future, you both know exactly where you stand in respect of the loan.

The Loan Agreement sets out the terms in which you have agreed to loan the money to them. Some of these terms might include:

Amount of the loan

Whilst the amount of the loan may have been agreed between you, how is it intended to be advanced? Will this be in one full payment or you might want to advance the money in instalments. Depending on the circumstances of the loan you might want the ability to lend additional amounts in the future and for those advances to be covered by the same terms.

Repayment of the loan

It has been agreed that the intention of loan is to be repaid and is not a gift to the borrower, so when will this be repaid? At the end of a specified duration or in instalments. If it is to be repaid in instalments, how much would each instalment be and the frequency in which each instalment is made.

Purpose of the loan

Why specify the purpose of the loan being advanced to the borrower? This focuses both the lender and borrower on why the money is being loaned and the purpose it is intended to be used for. This protects further protects the lender in the event that the borrower uses the money for illegal purposes.

Interest due on the loan

Is it intended that interest would accrue on the amount of the loan? If so, at what rate and how is this payable.

Events of default

Generally a lender does not have the right to request early repayment of the loan. Loan Agreements establish events of default which once triggered enables you the ability to demand repayment of the loan immediately. These event may include:

- the borrower fails to make payment as it falls due

- the borrower uses the loan for a purpose other than the one agreed

- the borrower become bankrupt

- the borrower dies

Whilst the above-mentioned is not intended to be an exhaustive list of events, these would be tailored to suit the nature of the transaction.

Security

Whilst the Loan Agreement is the key document establishing the lender/borrower relationship and governing the terms of the advance of money and the fact that the sum was not intended to be a gift. Securing the loan is beneficial to a lender, especially in the event that the borrower becomes bankrupt or is unable to make payments as they fall due. In the event that security is not given, the lender would then fall into a pool of general creditors awaiting recovery of the debt due (in some cases the full amount due may not be recoverable), where as if the lender has requisite security you would have priority over the general creditors, giving you a better chance of recovering the money that is due to you.

Whilst the above-mentioned is not intended to be an exhaustive list of provision which can be covered, the intention of any well-structured Loan Agreement is to safeguard against all eventualities and is bespoke to nature of the loan.

If you require any advice in relation to a Loan Agreement, contact Robyn and the Business Services team on 01604 828282 / 01908 660966 or email BusinessServices@franklins-sols.co.uk.

As a corporate lawyer I am regularly contacted by clients who have come to an impasse with their fellow business partner and looking for a solution in order for them to resolve the matter at hand and move the company and its business forward. My first question is always “do you have a Shareholders Agreement?”. Whilst I would love for the answer to be yes, more often the response is “no, but it’s on our to do list”.

As a corporate lawyer I am regularly contacted by clients who have come to an impasse with their fellow business partner and looking for a solution in order for them to resolve the matter at hand and move the company and its business forward. My first question is always “do you have a Shareholders Agreement?”. Whilst I would love for the answer to be yes, more often the response is “no, but it’s on our to do list”.

Without the presence of a Shareholders Agreement, it is difficult for an appropriate way for the impasse to be addressed without litigation, and whilst we have an amazing litigation team at Franklins who can help navigate and resolve your dispute, I am an advocate that prevention is better than cure.

So what is a Shareholders Agreement? This a private agreement between the shareholders of the company binding them to certain provisions protecting their individual interests and that of the company whilst offering a solution to resolve any issues encountered in a clear and amicable way. No two companies are the same, so when I am assisting clients with putting in place shareholders agreements I understand that the agreement needs to be bespoke to the shareholders and the nature of the company, addressing the following points:

- the rights, obligations and restrictions afforded to each of the shareholders;

- the type of business the company can undertake;

- matters which require directors to seek shareholders consent;

- the percentage required in order for a decision and resolution to be approved by the shareholders;

- procedures for dealing with company finances including obtaining financial assistance;

- the dividend procedure;

- the transfer, issue and variation of shares held in company;

- what happens to a shareholder and their shares held in the company if they are made bankrupt, enters into divorce proceedings, they die or they choose to leave the company;

- detailed provisions of an appropriate method for resolving a deadlock between the shareholders and disputes;

- rights of minority shareholders to tag-along with a third party offer to purchase share capital held in the company; and

- rights of majority shareholders to drag-along minority shareholders in a proposed share capital sale to a third party.

Whilst the above-mentioned is not intended to be an exhaustive list of provision which can be covered, the intention of any well-structured Shareholders Agreement is to safeguard against all eventualities.

Now whilst it is not compulsory for a Shareholders Agreement to be entered into by the shareholders, in view of recent unprecedented times it has become more favourable to have one in place in order to protect their individual interest and that of the company.

At Franklins we understand that you want a quick resolution that is also cost effective. We will work with you to provide specialist advice and ensure a full case plan is prepared to outline your options and next steps. Contact the Dispute Resolution Team on 01604 828282 / 01908 660966 or email Litigation@franklins-sols.co.uk.