- Milton Keynes 01908 660966

- Northampton 01604 828282

An Introduction to Selling your Business and Transaction Structures

Selling a business can be daunting. There are a multitude of considerations that you will need to have, decisions to make and unfamiliar processes to engage in. If you want a successful sale you need to prepare not only your business but yourself for the sales process. Doing so will not only maximise on your sale value, but reduce stress and anxiety by ensuring that you are fully appraised and confident in the decisions you make. In this series, I am going to consider five key elements of any transaction that a Seller will need to consider:

- Determining the structure of transactions

- Heads of Terms

- Due Diligence Enquiries

- Transaction Documents

- The teams involved in your transaction

Transaction Structures

Transactions can have a multitude of different structures and each deal will need to be tailored to you and impacted by how you have operated to date. However, there are two key principle ‘sale structures’ commonly adopted: Share Sales and Business Sales. Although each transaction will follow the same pathway of heads of terms, due diligence and transaction documents the actual documents themselves and risks involved in each transaction does vary significantly.

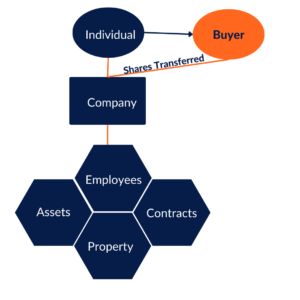

Share Sales

A Share Sale is more commonly preferred by Sellers where you have operated through an incorporated company. This is where you personally sell the shares that you own in your company to your buyer. The business itself remains ‘intact’ and therefore no property transfers, TUPE transfers or contract assignments are required which can help preserve the continuity of business and cause less disruption to the day to day running of the business.

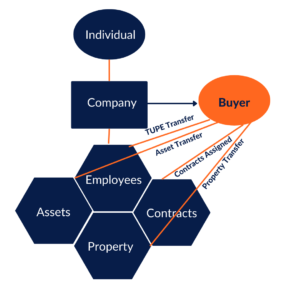

Business Sale

A ‘Business Sale’ or ‘Asset Sale’ (which are very similar in nature) is where an individual or a company sells the components or specific assets which together make up a business. Whilst this can be a lower risk from a buyer perspective, it can cause more disruption to the business as you have to transfer each asset and obligation to the buyer for them to continue the business and may involve TUPE transfers, property transfers and contract assignments.

Which is Best?

There are pros and cons to both structuring the deal as a Share Transaction or a Business/Asset Transaction.

Structuring the deal as a Share Transaction may:

- be more tax efficient for a seller

- involve a higher level of due diligence and disclosures

- involve a substantial number of documents to effect the share transfer and change of ownership itself

- increase the risk to a buyer as they inherit both liabilities and assets

- cause less disruption to the operation of business itself

Structuring the deal as a Business Transaction may:

- enable the buyer to ‘cherry pick’ assets and ‘leave behind’ certain liabilities

- involve more documentation to physically transfer the assets to the buyer

- cause more disruption to the business, especially if there are employees who need to be consulted on the pending transfer of the business

- involve more costs for the buyer, especially if property needs to be transferred which could incur Stamp Duty Land Tax

- Reduce the direct liabilities of the individuals involved in the deal if they operate through a selling company

Ultimately, every transaction will be different and what works for one set of parties may not work for another. It is about balancing the risks and benefits of the parties in each deal to agree a structure which both are happy to proceed on.

If you would like to know more about structuring deals and considerations in a pending sale, please don’t hesitate to contact Holly Threlfall or the team on 01604 828282 / 01908 660966 or email info@franklins-sols.co.uk

Who can help you with your structure?

Planning the structure of your transaction involves not only your solicitor, who can advise on the various risks and accountant, but also a broker (usually an expert in Corporate Finance) who can help with only valuing your business; this can be impacted by many factors including turnover, profit, industry multipliers and net asset value). Having an agent on hand who can help you construct a the deal in a manner that suits you and help you handle any key negotiation points early on is key to lining up a successful sale

What next?

Once you have agreed a structure in principle, it’s time to move onto Heads of Terms.